Banking, Compliance, and Control: What Chinese Founders Should Expect in Singapore

- Abigail D.

- Jan 26

- 2 min read

So, you’re thinking about setting up your next big venture in Singapore. Great choice! But before you pack your bags, let’s talk about the things that often surprise Chinese founders: banking, compliance, and control.

1. Banking: More Than Just Opening an Account

Question: “Can I just walk in and open a business account?”

Not exactly. Singapore banks love paperwork almost as much as they love stability. You’ll need:

Proof of incorporation and business address

Director’s identification (yes, passports count)

Business plan or company background

Witty insight: Think of it as a mini-interview. Banks want to know your business story before handing you a cheque book.

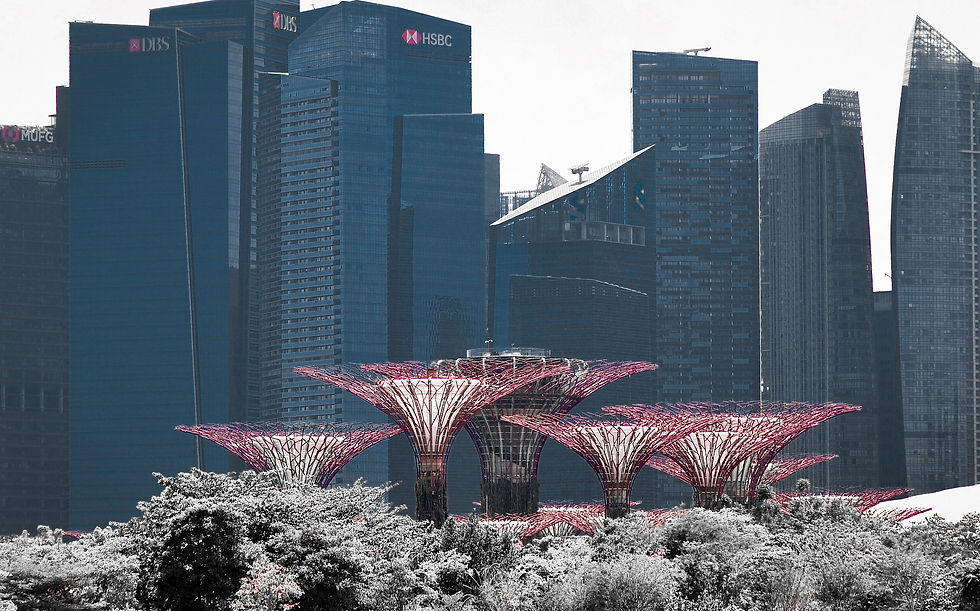

Pro tip: Major banks like DBS, OCBC, and UOB are founder-friendly, but digital banks like Aspire or Wise can save you headaches with international transactions.

2. Compliance: The “Rules” Aren’t Just Suggestions

Question: “How strict is Singapore really?”

Very. Singapore takes compliance seriously—think “polished, by-the-book, no shortcuts” serious. Key areas to watch:

Annual filings with ACRA (Accounting and Corporate Regulatory Authority)

Tax reporting with IRAS (Inland Revenue Authority of Singapore)

Anti-money laundering (AML) and Know Your Customer (KYC) checks

Witty insight: It’s like being a guest at someone else’s party—you follow the house rules, or you don’t get to stay long.

Pro tip: Having a local corporate service provider or accountant is almost mandatory. They’re your “compliance GPS.”

3. Control: Who Really Runs the Show?

Question: “Can I still call the shots?”

Absolutely—but with structure. Singapore law values transparency and good governance. This means:

Clear shareholder agreements

Proper director appointments

Board resolutions for major decisions

Witty insight: You’re the captain of the ship, but Singapore ensures the lifeboats are in place.

Pro tip: Don’t hand over shares to relatives or friends without proper agreements. Control is legal, not just personal.

4. Hidden Surprises Founders Often Face

Bank delays: Some accounts take 2–4 weeks to open. Patience is a virtue.

High compliance expectations: Penalties for late filings can be steep.

Professional fees: Expect to invest in accountants, corporate secretaries, and advisors—think of it as paying for peace of mind.

Question: “Worth it?”

Absolutely. These rules are why Singapore is globally respected: they protect your business, investors, and reputation.

5. Final Thoughts: Play Smart, Not Just Fast

If you’re expanding from China, Singapore rewards founders who:

Respect structure

Plan for compliance

Take control legally

Think of Singapore as the “luxury car” of business hubs—it won’t break down, but you still need to know how to drive.

Ready to start your Singapore venture the right way? We help Chinese founders with company incorporation, bank account setup, and compliance guidance—so you stay in control, legally compliant, and investor-ready.

Comments