China Startup to Singapore and the US: Structuring for Global Expansion

- Abigail D.

- Jan 26

- 3 min read

In today’s interconnected economy, Chinese startups are no longer limited to domestic markets. Many are using strategic corporate structuring to expand into Singapore and the United States, but this isn’t about geography alone.

It’s about designing a cross‑border corporate framework that enhances regulatory compliance, investor confidence, tax efficiency, and market access.

A New Reality for Chinese Founders

Global expansion isn’t just opening a foreign office — it’s a legal and financial transformation.

Startups rapidly discover that scaling internationally means navigating compliance in multiple jurisdictions, unlocking access to global capital, and optimizing tax efficiency so investors take them seriously.

This is not hypothetical. Analysts note a growing trend of Chinese firms relocating to Singapore to manage international exposure amid geopolitical tension and to tap trusted global markets.

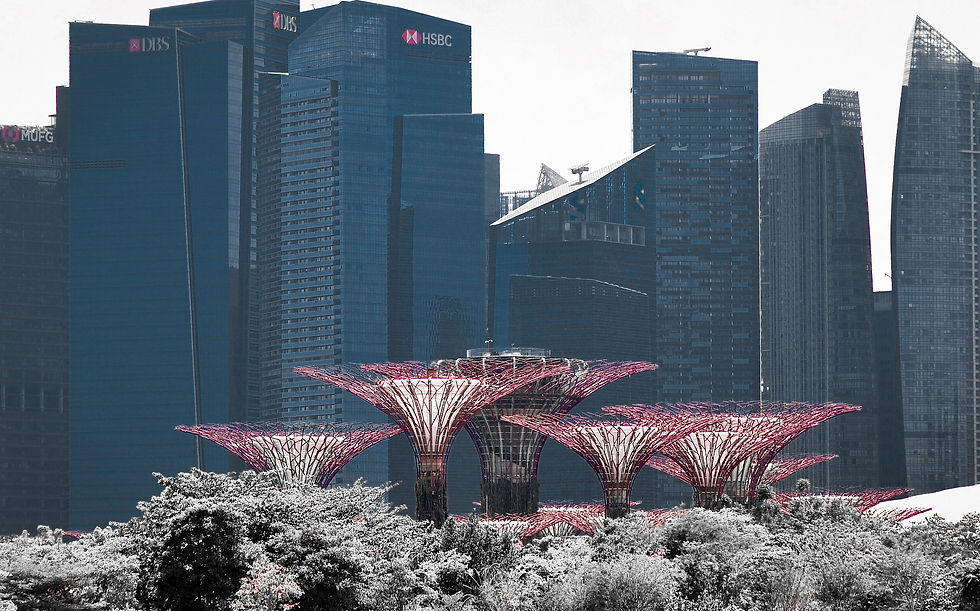

📍 Why Singapore Becomes the Strategic Hub?

Singapore has become the preferred staging ground for China startups heading toward the West — especially the US — for several core reasons:

1. Business Friendly Tax Environment

Singapore’s corporate tax rate is capped at 17%, and new companies can enjoy exemptions in their early years — sometimes reducing effective tax much lower.

There’s no capital gains tax or dividend tax, which is attractive for holding companies.

2. Double Tax Agreements

Singapore’s tax treaty network (including with China) helps prevent double taxation on income repatriated across borders.

3. International Credibility & Neutrality

Because Singapore’s legal system is transparent and pro‑business, global investors and regulators view Singapore entities as relatively low‑risk. This attracts international funding and smooths banking relationships.

The Standard Multinational Structure

A commonly used structure for China‑origin startups looking at Singapore and the US looks like this:

China Operating Entity → Singapore Holding / HQ Company → US Subsidiary

Why this works:

The Singapore HQ becomes the global controlling entity — important for investors and governance.

It holds intellectual property, access channels, capital, and compliance frameworks.

The US entity operates locally in America but reports through the Singapore holding entity for governance and financing.

This layered approach helps separate risks and keep each legal unit focused on its purpose.

Singapore’s Strategic Role Explained Singapore as a “Bridge” to Capital & Markets

Singapore’s ecosystem is a financial hub for venture capital, private equity, and global investors — especially for tech and deep‑tech founders.

These connections matter when raising funds destined for US market expansion.

Neutral Geopolitical Posture

Amid rising scrutiny on Chinese tech overseas, Singapore’s neutrality gives Chinese startups a credible base to negotiate international markets without being tagged as domestically confined.

Operational Efficiency

Setting up in Singapore typically takes only a few days, with streamlined legal and administrative processes supported by robust banking and legal institutions.

Why the US Is a Target — But Comes After

The US market remains one of the largest global consumer and investor markets — especially for tech startups. However:

US company structuring (like Delaware C‑corps) is essential to attract Silicon Valley funding — but it also comes with complex federal and state compliance and taxes.

By establishing a Singapore holding first, startups can create a clear ownership and governance path that US investors understand and trust.

This sequencing can save months of expensive restructuring later.

Founders run into trouble when they:

Skip structural design and incorporate in a foreign market first.

Treat Singapore as a shell rather than a functional headquarter with decision-making power.

Ignore tax, compliance, and investor expectations early on, which leads to costly corrections.

A solid corporate architecture prevents these pitfalls.

Expanding from China into Singapore and the United States isn’t just a tick‑box exercise — it’s a carefully engineered corporate journey. Successful founders don’t just think about where they want to go; they think deeply about how their organization should be structured before entering global markets.

That architecture decides their ability to fundraise, comply with regulators, protect assets, and compete on the world stage.

If you’re planning to expand from China to Singapore or the US, we offer business incorporation services, Singapore HQ assessments, and guidance on global expansion, so you can start strong, stay compliant, and set your startup up for success.

Comments