How to Set Up a Company in Singapore as a Foreigner (2025 Guide)

- Nardia F.

- Dec 17, 2025

- 4 min read

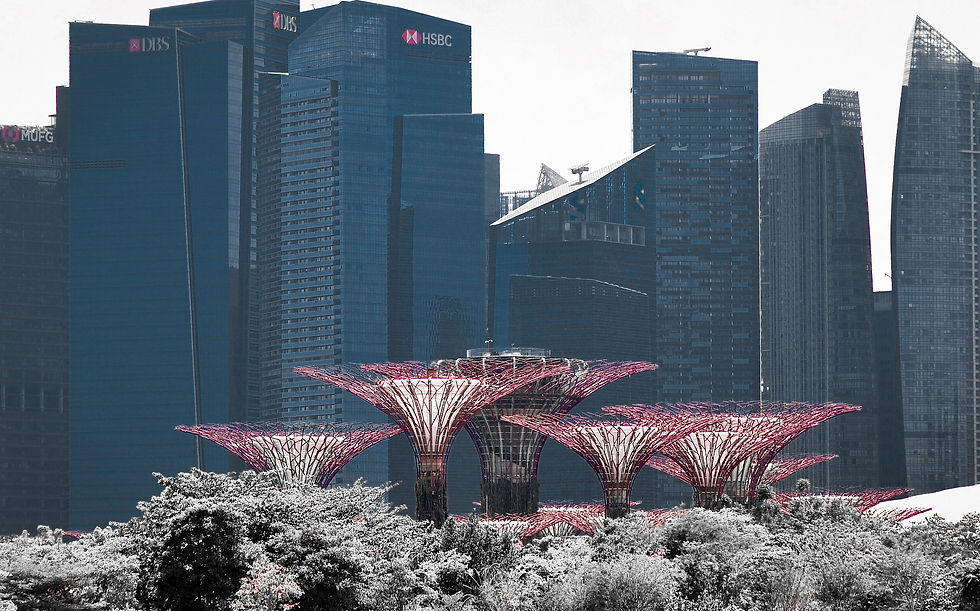

Singapore consistently ranks among the world’s easiest and most attractive places to start a business. Its strategic location in Southeast Asia, robust legal framework, low and transparent taxes, and strong protection of investor rights make it a prime destination for global entrepreneurs. As a foreigner, you can fully own a company in Singapore — but there are specific legal and administrative requirements you must meet. (BBCIncorp Group)

Why Singapore? The Competitive Advantages

Singapore’s pro-business environment offers many benefits, including:

100% foreign ownership allowed for most private companies. (BBCIncorp Group)

Fast online incorporation via the Accounting and Corporate Regulatory Authority (ACRA). (BBCIncorp Group)

Low corporate tax rate (17% with generous tax exemptions for startups). (BBCIncorp Group)

World-class infrastructure and strategic access to Asia Pacific markets. (BBCIncorp Group)

These factors position Singapore as a gateway for businesses targeting Asia and beyond.

Step-by-Step: Setting Up Your Company in Singapore

Here’s a clear roadmap for foreigners looking to incorporate in Singapore in 2025.

1. Choose Your Business Structure

The most common and recommended structure is a Private Limited Company (Pte Ltd). It:

Limits liability to the company.

Is recognized by banks, investors, and government agencies.

Can be 100% owned by foreign shareholders. (BBCIncorp Group)

There are alternatives (e.g., branch office, representative office) for foreign entities that don’t want a separate Singapore company, but these have limitations and tax implications. (sicc.com.sg)

2. Pick and Reserve a Business Name

You begin by selecting a unique name and submitting it for approval via ACRA’s BizFile+ online portal. Once approved, the name is reserved for a limited time (120 days). (BBCIncorp Group)

Tips for choosing a name:

Avoid offensive or misleading terms.

Ensure the name isn’t trademarked or in use by another company.

3. Meet the Key Legal Requirements

All Singapore companies must satisfy several statutory conditions:

Local Director

You must appoint at least one director who is ordinarily resident in Singapore — meaning a Singapore Citizen, Permanent Resident or a foreigner holding an eligible work pass (e.g., Employment Pass, EntrePass). (BBCIncorp Group)

If you don’t qualify yourself, many foreigners use a nominee director service from a corporate service provider. (Sleek)

Minimum Share Capital

The minimum paid-up capital requirement is just SGD 1 (approximately USD 0.70). (Alitium)

Registered Office Address

Your business must have a physical Singapore address for official correspondence (a P.O. Box is not allowed). (Alitium)

Company Secretary

Within six months of incorporation, you must appoint a company secretary who is a Singapore resident. (Alitium)

4. Engage a Corporate Service Provider

Foreigners cannot directly file company incorporation documents through ACRA without a SingPass digital identity or an eligible work pass with SingPass access. Because most foreigners don’t yet have this, you will typically work with a registered corporate service provider (sometimes called a filing agent), who will:

Reserve the company name.

Prepare and file incorporation documents.

Provide nominee director and registered office services if needed. (BBCIncorp Group)

The government fees for registration are fixed — currently around SGD 315 (SGD 15 for name reservation + SGD 300 for incorporation). (BBCIncorp Group) Corporate service providers charge additional fees for compliance services.

5. Receive Incorporation Documents

Once ACRA approves your application (which typically takes 1–3 business days if everything is in order), you will receive:

Certificate of Incorporation

Unique Entity Number (UEN)

Business Profile from BizFile+

This officially marks the legal birth of your Singapore company. (BBCIncorp Group)

6. Open a Corporate Bank Account

After incorporation, set up a business bank account. Many traditional banks require a face-to-face visit, though digital banks and financial platforms (e.g., Wise Business, Aspire) offer more remote-friendly options. (Pullupstand.com Pte Ltd)

Make sure you have your UEN and corporate documents ready.

7. Work Passes and Visas (Optional)

If your goal is to move to Singapore and manage the company on site, you must apply for an appropriate work pass:

Without a work pass, you can still own and run your Singapore company from overseas with the help of local directors and service providers. (BBCIncorp Group)

Post-Incorporation Compliance

Setting up is just the beginning. Singapore companies must also:

File Annual Returns with ACRA

Submit corporate taxes to the Inland Revenue Authority of Singapore (IRAS)

Maintain accurate accounting records

Hold Annual General Meetings (unless exempt) (BBCIncorp Group)

Many foreign entrepreneurs outsource accounting and company secretarial services to stay compliant.

Final Tips for Foreign Founders

✅ Singapore allows 100% foreign ownership. (BBCIncorp Group)

✅ You don’t need to live in Singapore to own a company, but you will need a local resident director. (Sleek)

✅ Professional help (corporate service providers) can make the process much smoother. (kca.sg)

✅ Plan ahead for banking and compliance to avoid delays.

By understanding requirements and using available services wisely, registering your Singapore company as a foreigner in 2025 can be fast, efficient, and highly rewarding — giving you access to one of the world’s most dynamic business hubs. (BBCIncorp Group)

Comments